As organizations scale, the need for external capital often becomes inevitable. Whether it’s for hiring, entering new markets, investing in technology, or fueling M&A activity, securing the right ki

...BLOG

Real Strategies. Real Results.

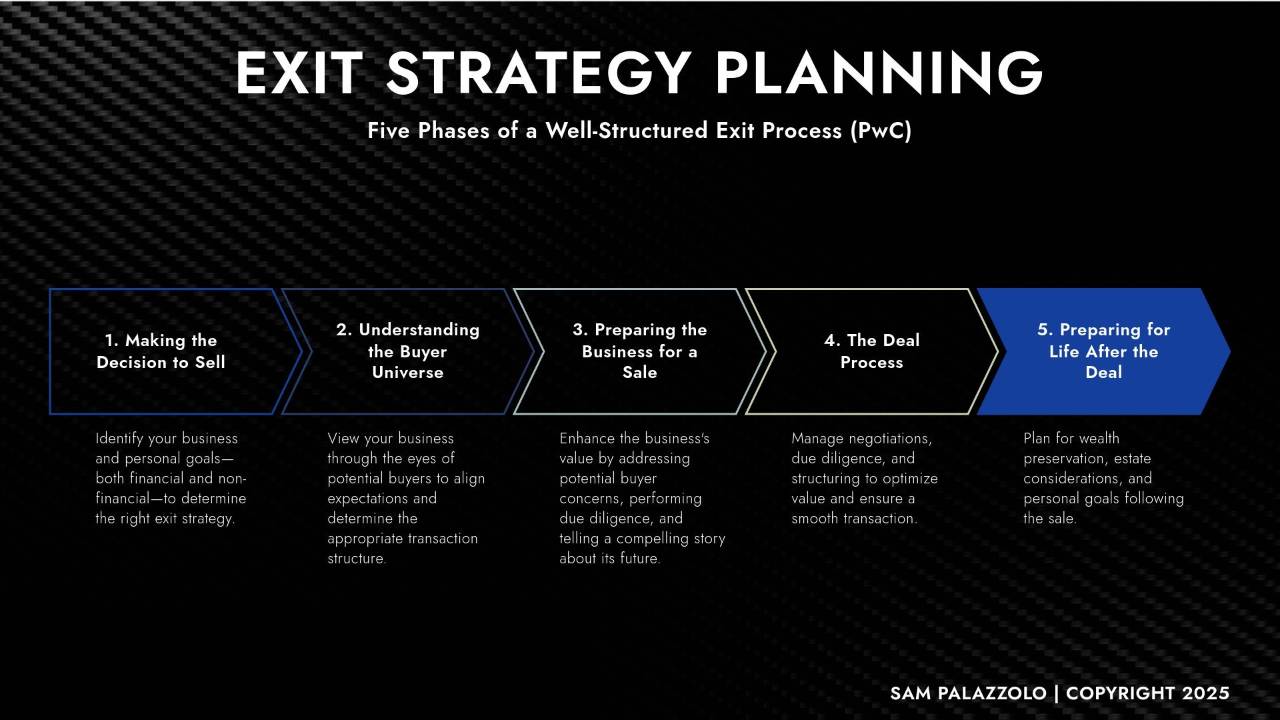

Most leaders obsess over revenue targets, market expansion, and operational efficiency. What often gets neglected—ironically—is the single event that determines whether all that effort pays off: The E...

Mergers and acquisitions (M&A) offer one of the most compelling—yet complex—growth strategies available. Done well, M&A accelerates market entry, expands capabilities, and creates operational leverage...

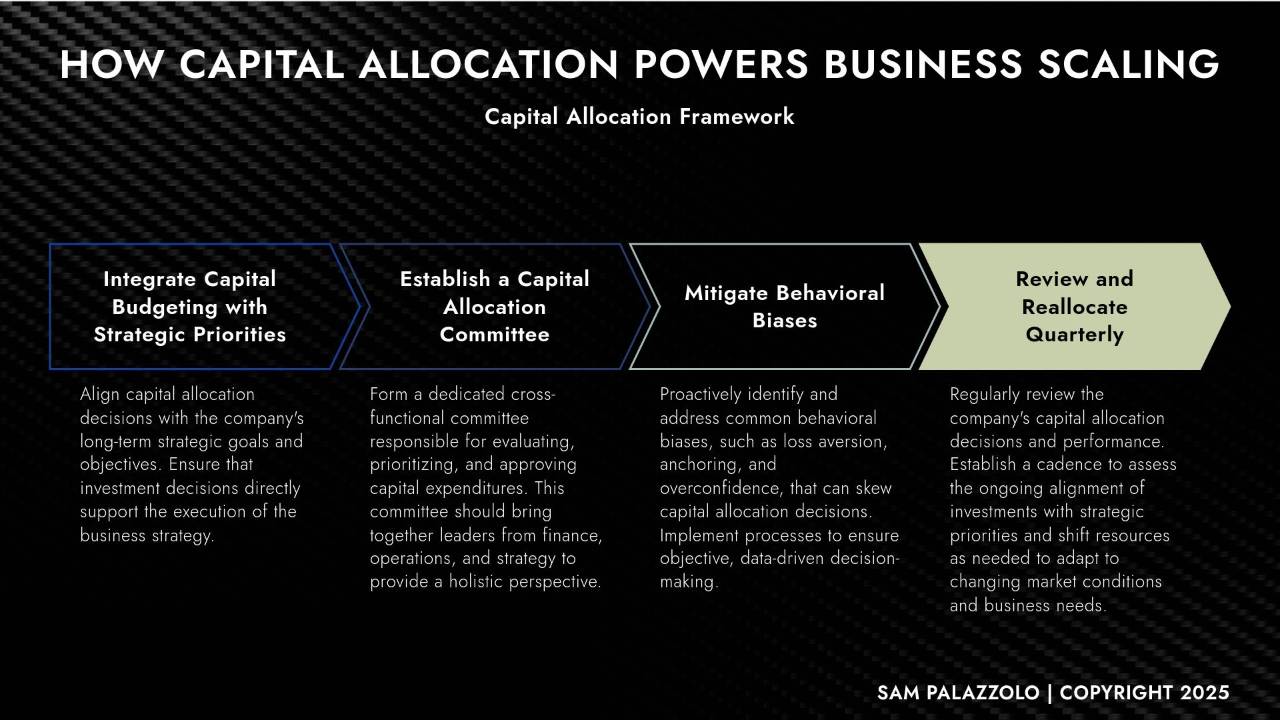

Raising capital has become almost a rite of passage for businesses at every stage. But capital alone doesn’t create growth — how a company allocates that capital determines whether it scales efficient...

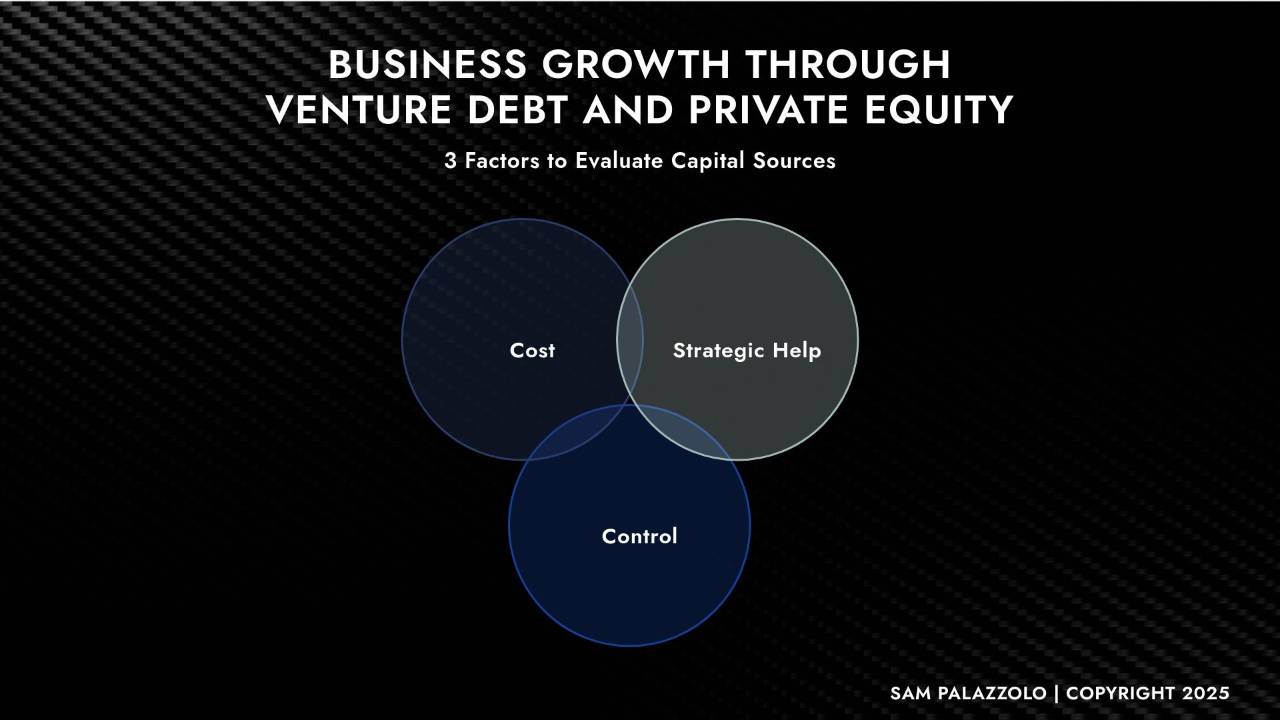

High interest rates, compressed multiples, and margin pressure have business leaders rethinking how they finance growth. Traditional venture capital isn’t the only game in town. For companies looking ...

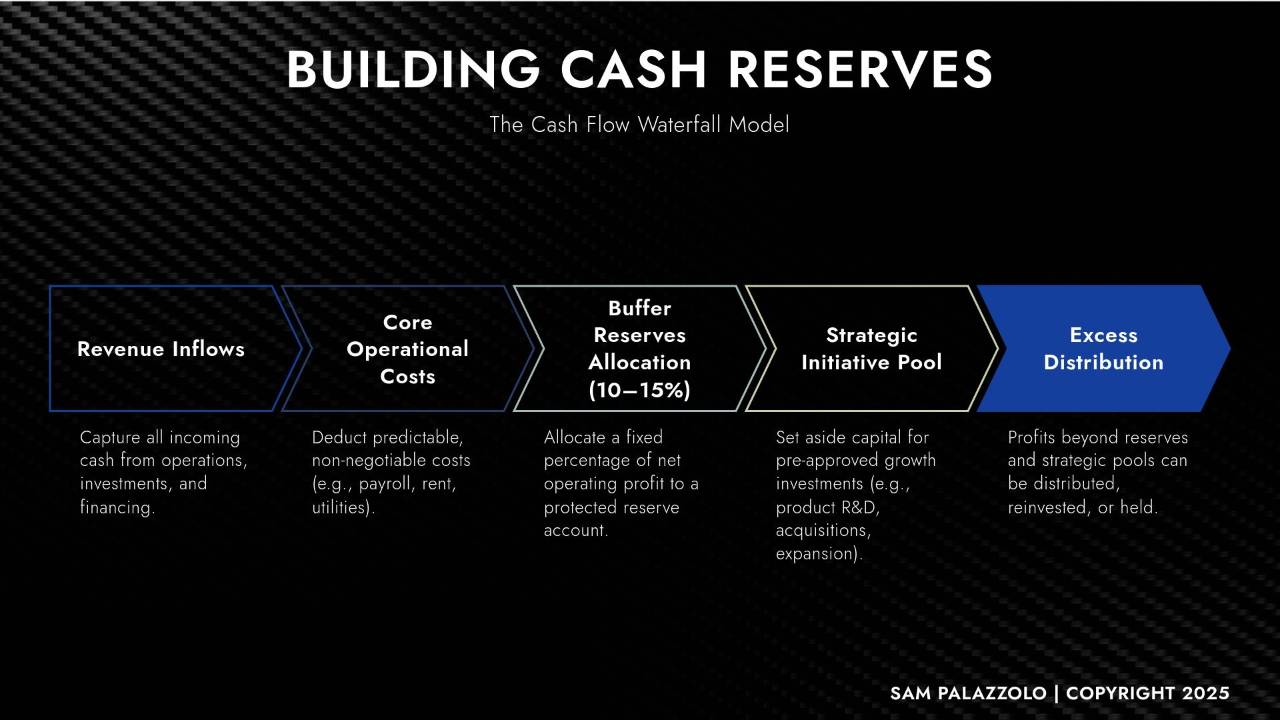

There’s a paradox that even experienced leaders fall victim to: the faster you grow, the more cash you need—and often, the less you have.

While capital efficiency and burn rate are common boardroom t...

It’s one of the most avoidable reasons businesses fail — and yet it happens every day…

According to U.S. Bank, 82% of failed businesses cite poor cash flow management as a primary reason. Think about...