How Capital Allocation Powers Business Scaling

Apr 29, 2025

Raising capital has become almost a rite of passage for businesses at every stage. But capital alone doesn’t create growth — how a company allocates that capital determines whether it scales efficiently or struggles to survive. Recent research underscores this stark reality: companies that implement disciplined capital allocation strategies achieve 30–50% higher returns on invested capital (ROIC) compared to their peers, according to Bain & Company.

Meanwhile, a McKinsey & Company study found that 40% of corporate underperformance stems directly from poor capital allocation decisions.

Scaling businesses must recognize that capital is not a guarantee of success — it is a magnifier of operational and strategic decisions, for better or worse.

The Hidden Risks of Capital Misallocation

While capital infusions can enable innovation, expansion, and talent acquisition, misallocation remains a critical threat across industries. Common pitfalls include:

- Lack of Strategic Prioritization: Funding too many disconnected initiatives dilutes impact and focus.

- Overinvestment in Low-Impact Areas: Resources are often consumed by projects that fail to drive core growth.

- Inflexibility to Reallocate: Companies that cannot pivot capital allocations when market conditions shift lose momentum.

- Internal Political Pressures: Capital is sometimes distributed based on internal lobbying rather than strategic necessity.

- Poor ROI Measurement: Without clear metrics, leaders have no insight into whether investments are producing the intended outcomes.

Misallocating capital is not merely inefficient — it directly stunts growth, drains momentum, and undermines strategic objectives.

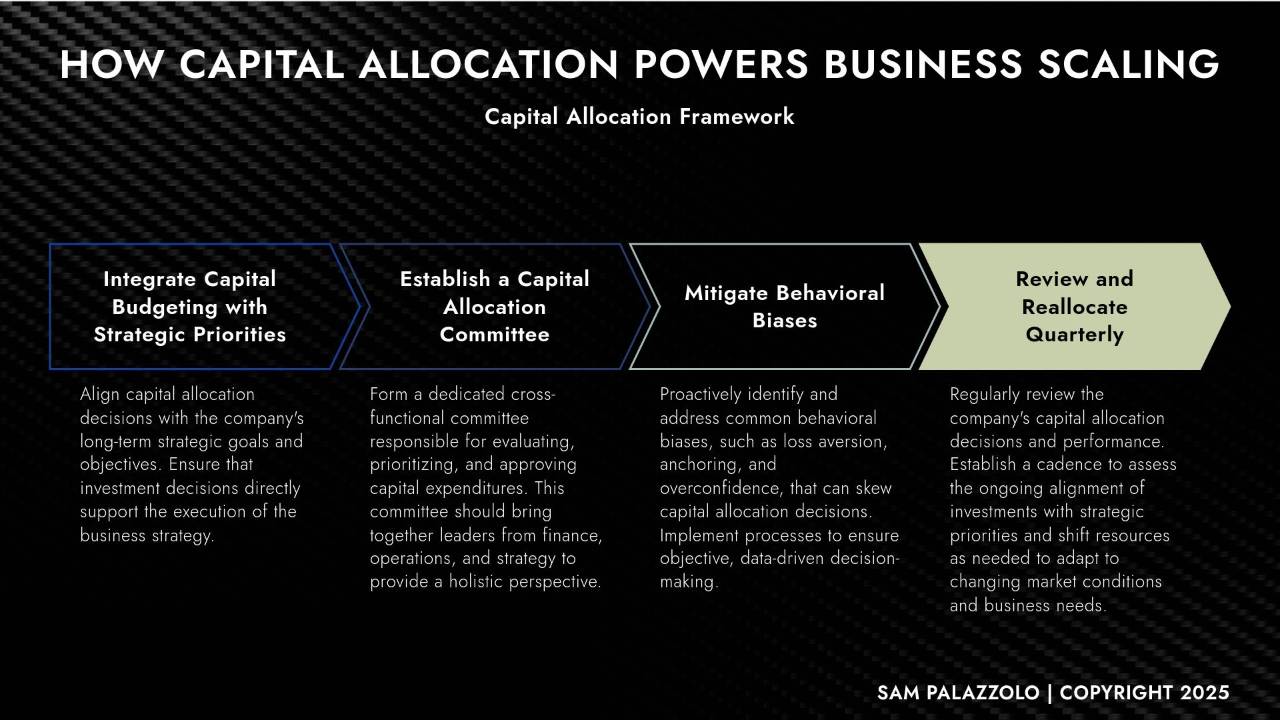

A Strategic Framework for Capital Allocation

To avoid these pitfalls, disciplined organizations employ structured frameworks for allocating capital intelligently and dynamically. One such approach is the Capital Allocation Framework adapted from Sinha (2023), which outlines four critical principles:

1. Tie Capital to Strategic Priorities

Capital allocation must be directly linked to long-term strategic goals. Initiatives that do not clearly map to growth objectives, market expansion, or operational excellence should not be funded. This strategic rigor ensures that resources are channeled where they can drive the most value.

2. Establish a Cross-Functional Capital Allocation Committee

To remove individual biases and political influences, leading organizations build cross-functional committees that include finance, operations, and strategy leaders. This group evaluates investment opportunities objectively and ensures alignment with enterprise priorities, not departmental preferences.

3. Defend Against Behavioral Bias

Psychological traps — such as loss aversion, anchoring, or overconfidence — can derail even the most well-intentioned capital plans. Structured decision-making processes, with clear evaluation criteria and stage-gate funding reviews, help organizations stay objective.

4. Review and Reallocate Quarterly

Capital allocation is not a “set it and forget it” exercise. Dynamic markets demand that businesses regularly reassess performance and reallocate resources toward initiatives demonstrating the highest returns. Quarterly reviews ensure that capital continuously flows to areas of greatest opportunity.

Real-World Application: Turning Capital into Growth

Consider a technology firm that had raised $10 million in growth capital but struggled to gain market traction. Initial allocations were spread thinly across marketing, product development, and operational scaling — without a clear strategic map.

Upon implementing a disciplined Capital Allocation Framework, leadership redirected 60% of available capital toward a high-performing customer acquisition channel that had previously been underfunded. Non-core projects were either paused or re-scoped. A cross-functional team managed reallocation decisions quarterly based on live performance data.

The results were significant:

- Customer acquisition costs dropped 28% within two quarters.

- Top-line revenue grew 42% year-over-year.

- The business moved from negative cash flow to profitability in 18 months.

Capital was no longer a passive asset. It became a scaling engine — because it was allocated, monitored, and reallocated with discipline.

Actionable Takeaways: Making Capital Work for You

Capital is a tool — but without strategic discipline, it becomes a liability.

Businesses that scale efficiently treat capital allocation as a dynamic, strategy-driven process:

- Prioritize initiatives that map directly to growth.

- Build governance structures to eliminate bias.

- Set quarterly reviews to adapt faster than competitors.

- Invest aggressively where returns are measurable — and cut ruthlessly where they are not.

Those who master capital allocation position themselves not just to survive funding rounds — but to scale smart and lead markets.

Sam Palazzolo, Principal Officer @ The Javelin Institute

P.S. – Scale Smarter This Year?

If you’re serious about scaling your business strategically, I invite you to join one of our upcoming sessions:

- Sales & Marketing Acceleration Program — Learn how to compress sales cycles and unlock growth within 90 days. Find out more: https://javelininstitute.org/sales-marketing-acceleration-program/

- CEO Catalyst Program — Build yourself, your team, and your business to lead and scale with real strategies and real results. Find out more here: https://sampalazzolo.com/

KEY TAKEAWAYS

- 40% of corporate underperformance is caused by poor capital allocation (McKinsey).

- Disciplined capital allocation delivers 30–50% higher ROIC (Bain).

- Misallocation risks: lack of prioritization, overinvestment, inflexibility, political pressures, poor ROI tracking.

- The Capital Allocation Framework emphasizes tying spending to strategy, cross-functional governance, bias mitigation, and quarterly reallocation.

- Real-world application shows that strategic reallocation can significantly boost revenue growth and profitability.

- Capital magnifies leadership decisions — and mastering allocation is a key differentiator in scaling success.

SUBSCRIBE FOR WEEKLY BUSINESS SCALING STRATEGIES

REAL STRATEGIES. REAL SOLUTIONS.

We respect your privacy. Unsubscribe at any time.