Venture Debt and Private Equity: Smart Capital Strategies for Business Growth

Apr 21, 2025

High interest rates, compressed multiples, and margin pressure have business leaders rethinking how they finance growth. Traditional venture capital isn’t the only game in town. For companies looking to scale intelligently—without compromising control or strategic clarity—venture debt and private equity offer distinct paths forward.

Both options have surged in popularity, yet many leaders fail to evaluate them strategically. This article introduces a pragmatic framework for capital decision-making—based on academic research and real-world application—designed to help organizations scale with confidence and control.

The Rising Role of Alternative Capital

It’s easy to default to the status quo—equity rounds, convertible notes, or venture capital syndicates. But the market has shifted.

In 2022, the U.S. venture debt market grew to $32 billion, accounting for nearly 20% of total venture funding. Once considered a niche instrument, venture debt is now a mainstream option for companies with recurring revenue and defined growth plans.

Private equity, meanwhile, remains a force multiplier. According to Bain & Company, companies backed by private equity grow 35% faster and expand EBITDA margins by 23% more than their peers. PE firms provide more than capital—they deliver operational expertise, M&A execution support, and governance infrastructure.

So what’s the catch?

Each path comes with trade-offs. Founders who take multiple equity rounds often find themselves with just 15–25% ownership by the time they reach Series C. PE partners may require board seats, aggressive timelines, or restructuring strategies that conflict with a founder’s original vision.

A Framework for Evaluating Capital Options

To navigate these decisions, business leaders need more than term sheets—they need a framework.

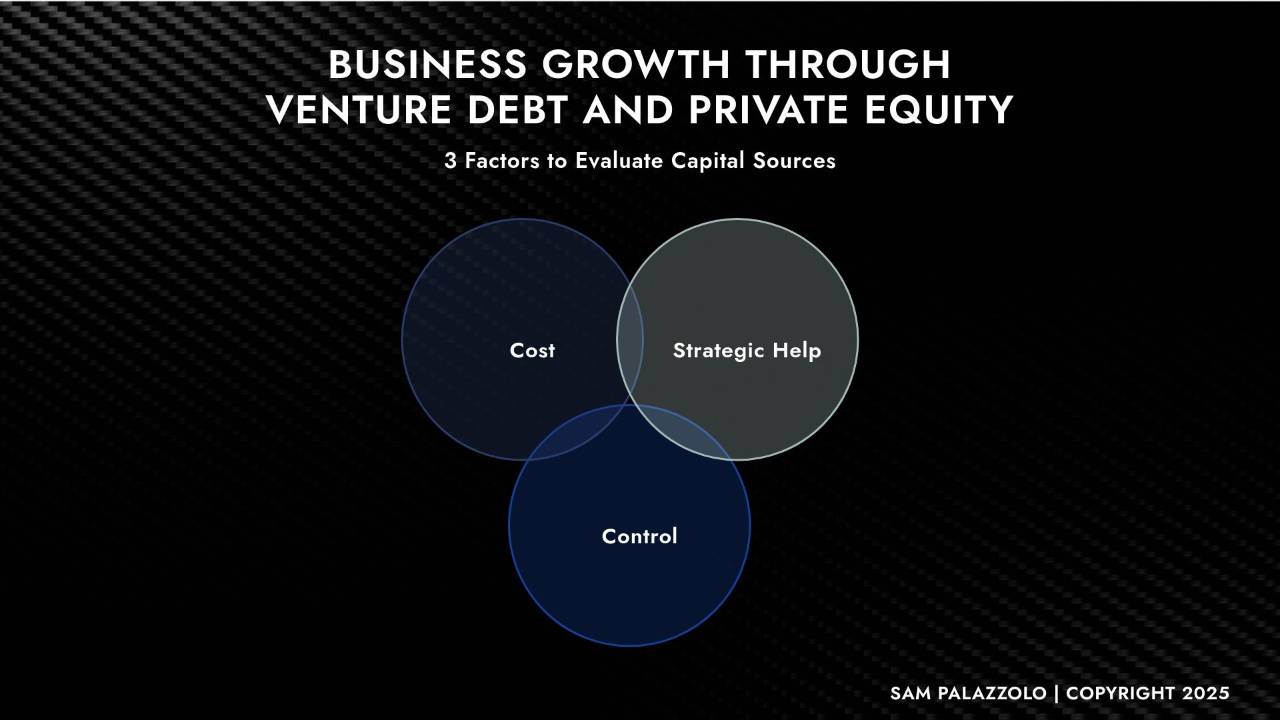

Based on research by Gompers, Kaplan, and Mukharlyamov (2022), the Capital Structure Planning Framework evaluates funding options across three critical dimensions:

1. Control

Venture debt is largely non-dilutive, allowing founders and executive teams to retain ownership and voting rights. It’s best suited for businesses with predictable cash flow and a need for short- to mid-term capital.

Private equity, by contrast, involves partial or majority ownership transfers. In exchange for a capital infusion and strategic support, founders often relinquish decision-making autonomy or board representation.

Ask yourself: Are you ready to give up control—or do you need to retain leverage through your next growth phase?

2. Cost of Capital

Venture debt incurs repayment obligations with interest, typically amortized over 2–4 years. While it preserves equity, it does introduce risk if cash flows tighten unexpectedly.

Private equity is equity-based capital with no repayment requirements—but it’s not free. The cost comes through dilution and profit-sharing at exit.

Ask yourself: Which is riskier—taking on debt with repayment terms, or giving up equity now that may be worth far more later?

3. Strategic Value

This is where private equity shines. Top-tier firms bring battle-tested operational playbooks, executive hiring capacity, and experience navigating complex transformations.

Venture debt providers typically offer minimal strategic involvement. Their value lies in capital access—not partnership.

Ask yourself: Do you need a check—or a team?

Case Study: Scaling with Structure

A high-growth B2B SaaS company recently faced this crossroad. With $15M in ARR and plans to enter two international markets, the founder needed $5–7M in growth capital.

Initial instincts pointed to another equity round. But after evaluating the Capital Structure Framework, the leadership team recognized the costs: a second equity raise would dilute the founder’s ownership below 25% and introduce more investors with conflicting strategic expectations.

Instead, they structured a venture debt agreement with a leading tech lender—leveraging their strong cash flow and historical burn reduction. The result: non-dilutive capital, extended runway, and full control over expansion timelines.

One year later, they successfully launched in both markets—and retained 78% founder ownership.

Closing Thoughts: Match Capital to Strategy

Too often, funding decisions are reactive. A round closes, a partner is introduced, and only later do leaders confront the downstream impact—reduced ownership, misaligned expectations, or capital constraints that don’t match the company’s trajectory.

Capital should follow strategy, not the other way around.

Whether you choose venture debt for its efficiency or private equity for its operational depth, the goal is alignment. Use the Capital Structure Planning Framework as your decision lens—not a pitch deck or investor preference. It’s a simple but powerful tool that puts leaders back in control of their scaling journey.

Sam Palazzolo

Real Strategies. Real Results.

Want More Real Strategies?

Subscribe to my Business Scaling Newsletter for insights like these—delivered weekly. You’ll receive a free copy of my 50 Scaling Strategies eBook ($50 value) just for signing up here: https://sampalazzolo.com

SUBSCRIBE FOR WEEKLY BUSINESS SCALING STRATEGIES

REAL STRATEGIES. REAL SOLUTIONS.

We respect your privacy. Unsubscribe at any time.