Employee engagement has slipped to troubling lows. In 2024, only 31% of U.S. employees reported being engaged at work, the lowest level in a decade (Gallup, 2025). Meanwhile, just 26% strongly agree...

BLOG

Real Strategies. Real Results.

Leadership isn’t failing because the world is more complex. It’s failing because leaders are expected to operate at game speed without a game plan. In the National Football League, play calling is the...

As organizations grow, the demands on leadership evolve faster than most teams are prepared to handle. The complexity that accompanies scaling—new markets, expanded product lines, additional managemen...

As organizations evolve, growth exposes the limits of leadership design.

What worked at $10 million in revenue starts breaking at $100 million.

Decision rights blur. Meetings multiply. Accountability th...

The Accountability Illusion

Every CEO claims to run a goal-driven company. But most of what’s written in their OKRs or quarterly decks could be replaced with “do more things.”

Setting measurable goa...

Vision is easy to announce and hard to operationalize. Most leadership teams overestimate their clarity and underestimate the friction created by ambiguity. As organizations scale, a poorly engineered...

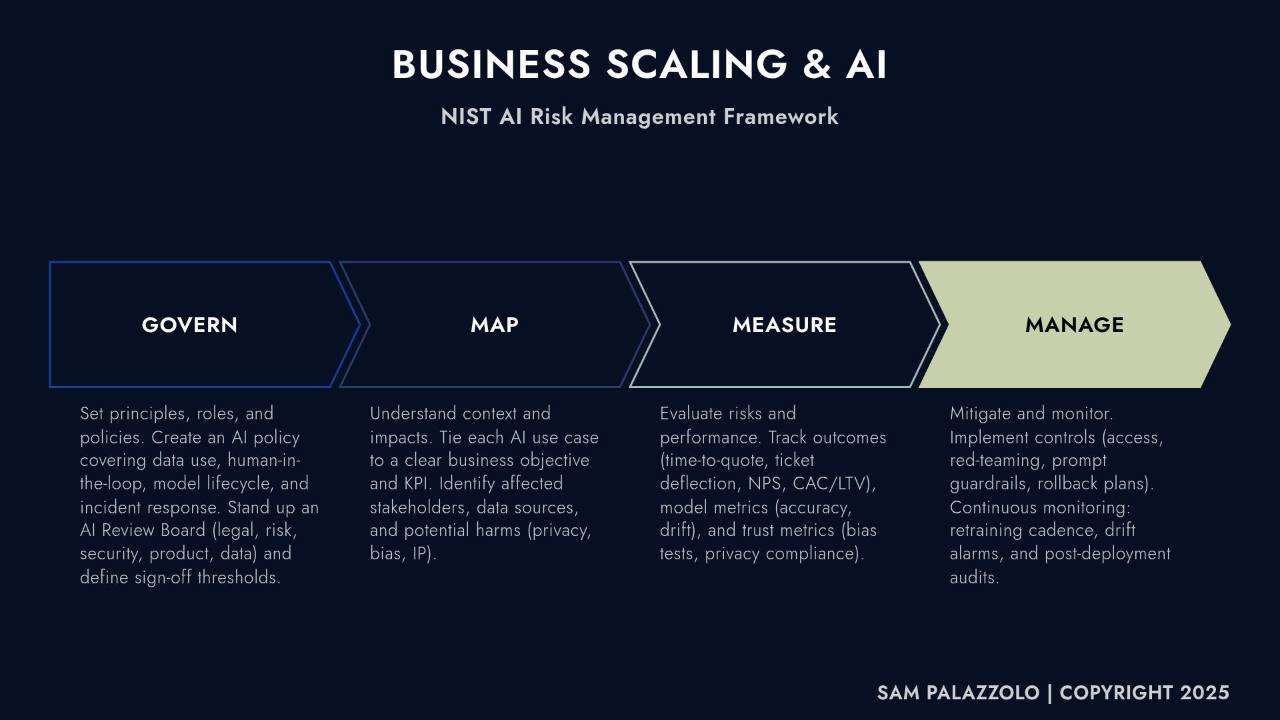

From my vantage point, we’re at the AI “Tip of the Spear” and most Leaders don’t lack AI ideas; they lack repeatable ways to turn those ideas into measurable results. The most common pattern I see wit...

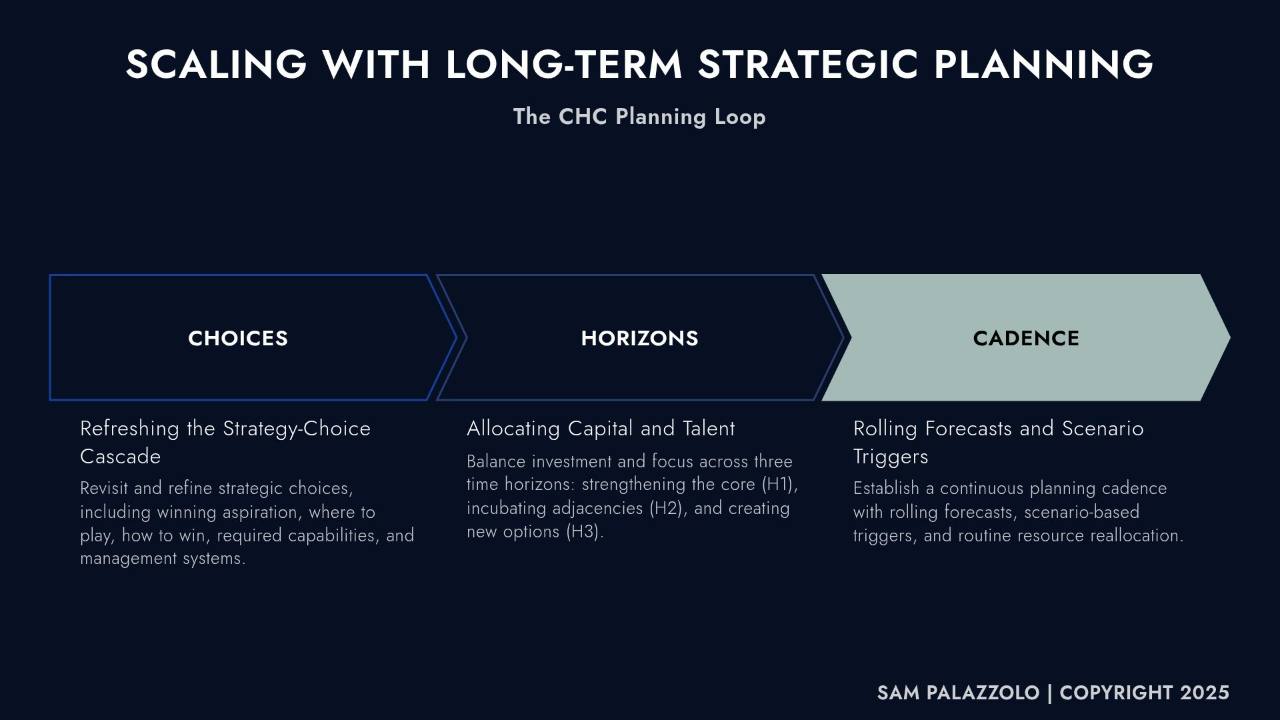

When I began my career in Strategic Planning at General Motors, the discipline was built around 10-year roadmaps. Organizations invested months producing thick binders and glossy decks that laid out “...

For years, sustainability and corporate responsibility were treated as peripheral concerns—something to highlight in annual reports or marketing campaigns. Today, they are central to strategy and grow...

There’s a paradox in managing growing pains. Business leaders often assume that growth solves problems. Yet research shows the opposite: growth introduces complexity, strains organizational systems, a...

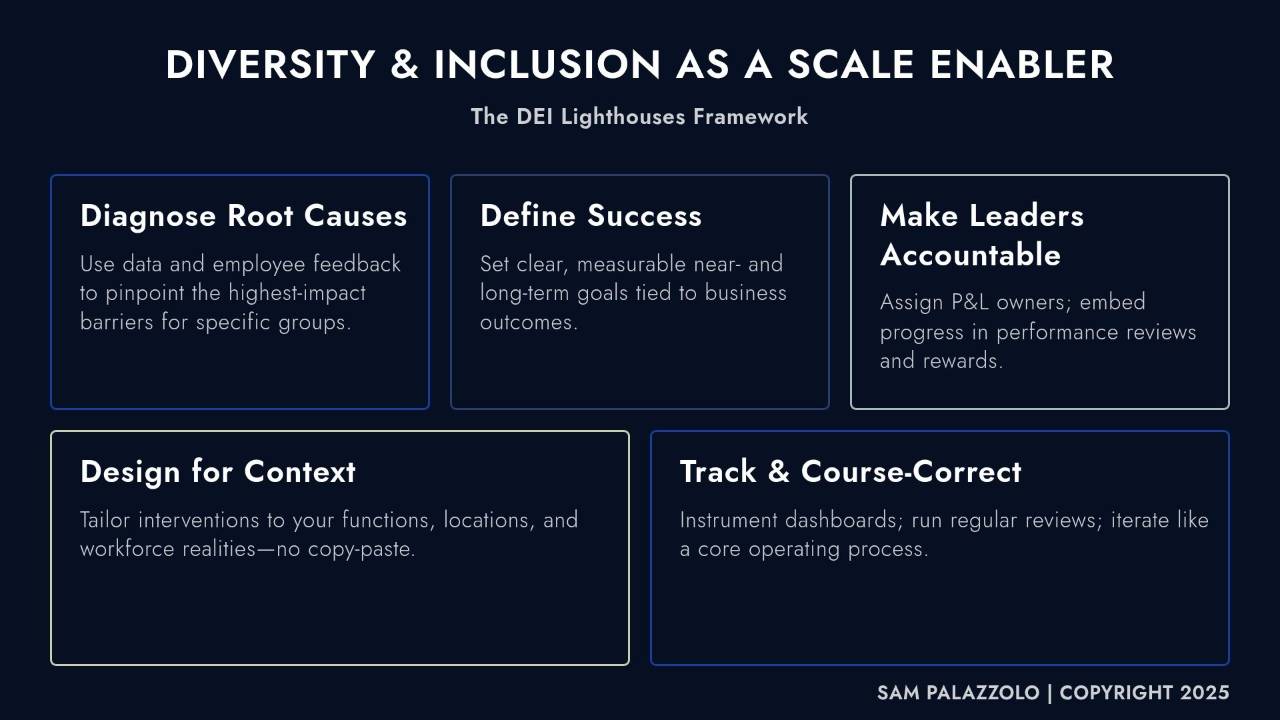

For leaders focused on scaling organizations, discussions around diversity and inclusion (D&I) often get parked in the “HR initiative” bucket. Yet mounting evidence shows D&I is not a side project but...

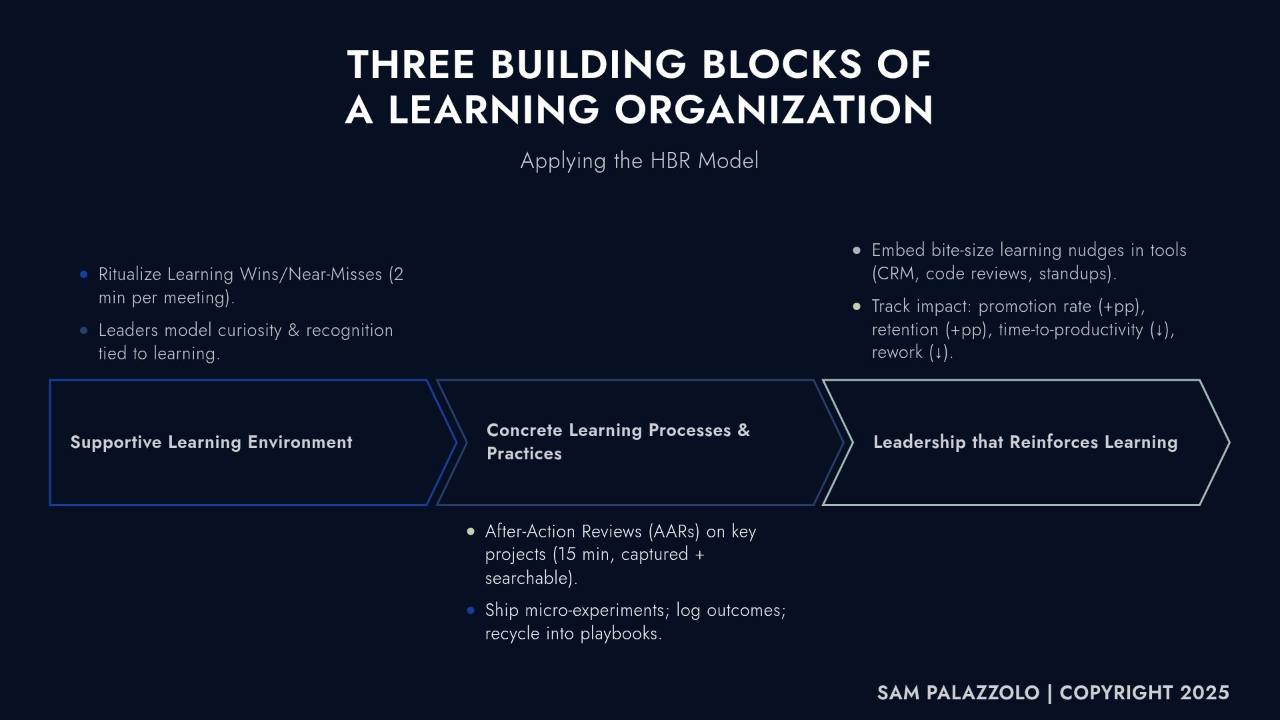

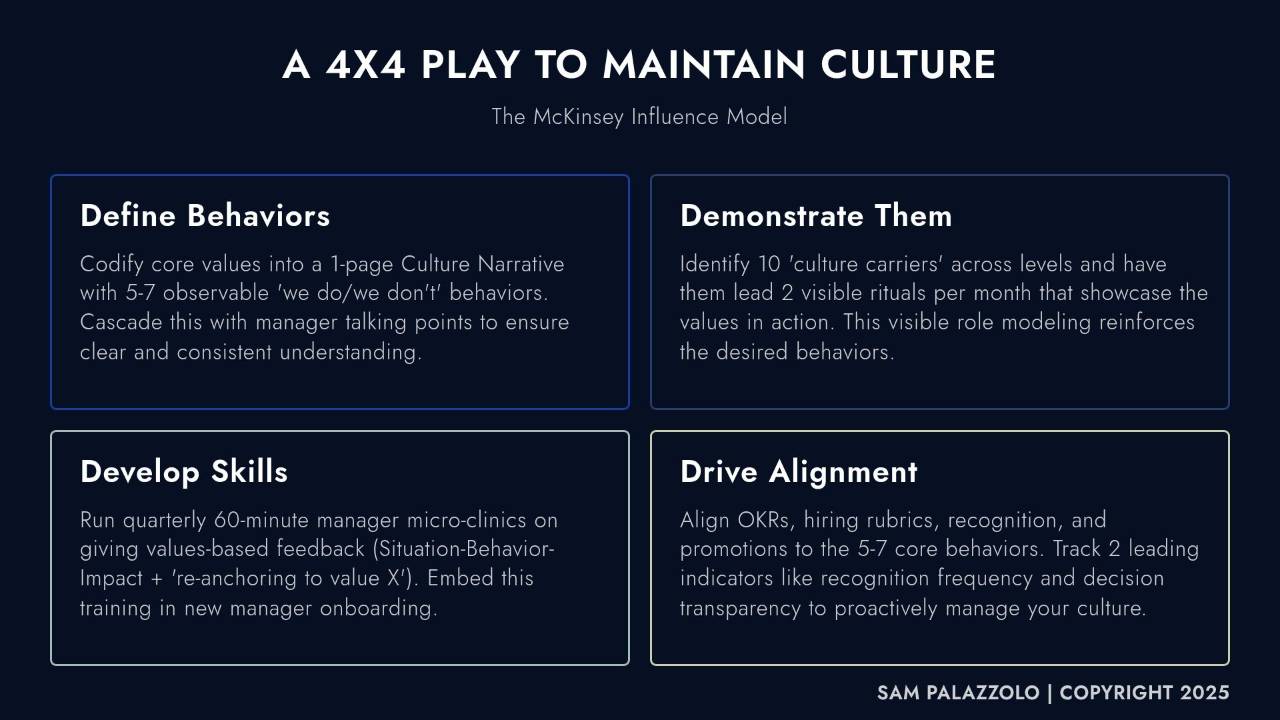

Organizations rarely lose momentum because of strategy alone. More often, growth stalls because the culture that fueled early success doesn’t scale with the business. Leaders know this instinctively, ...